I’m creating a list of the greatest FTSE 100 value stocks to buy for my Stocks and Shares ISA. Here are two I’m hoping to pick up when I next have cash to invest.

Electrifying value

Renewable energy stock SSE (LSE:SSE) has been one of the Footsie’s biggest fallers since the start of 2024. Speculation that UK interest rates may not fall as sharply as was hoped during December’s Santa Rally have dampened investor interest in the company.

Higher rates are bad for debt-heavy companies like utilities. This particular business had net debt and hybrid capital of £8.9bn on its balance sheet as of September.

I still believe SSE shares are a brilliant buy today whether interest rates plummet or not. They trade on a forward price-to-earnings (P/E) ratio of 11.2 times for this financial year (to March 2024). And the multiple drops to a rock-bottom 10.1 times for financial 2025.

Green giant

This is a very tasty valuation given SSE’s excellent defensive qualities, in my opinion. I certainly expect its earnings to remain more stable than those of most other UK shares if the macroeconomic landscape worsens.

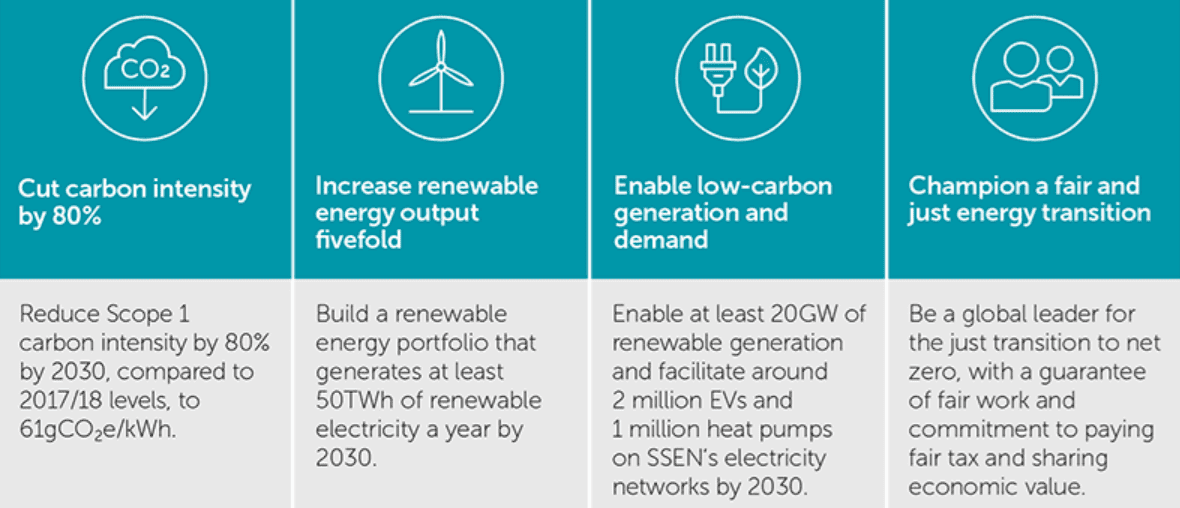

I also don’t think SSE’s current share price reflects its exceptional growth potention. Demand for green energy is booming as the world transitions from oil and gas. And the business plans to rapidly expand its wind capacity over the next 10 years to capitalise on the green electricity phenomenon.

Its five-year, fully-funded £18bn investment plan that runs until 2027 will see it build projects like Dogger Bank, the world’s largest offshore wind farm. And last May it announced plans to keep spending heavily beyond this period: it pledged to invest up to £40bn in green energy in the decade to financial 2032.

One final thing: while SSE rebased the dividend more recently, payout predictions for the next two years provide healthy dividend yields of 3.4% and 3.6%. These provide an added bonus for fans of value stocks.

Another FTSE 100 bargain

I first added Aviva (LSE:AV.) shares to my Stocks and Shares ISA in October. And I’m hoping to increase my stake in the life insurance giant in the near future.

This Footsie share trades on a forward-looking P/E ratio of 9.5 times. And its dividend yield stands at a magnificent 8%, too.

Now Aviva doesn’t have the sort of resilience as SSE in tough times. Unlike with electricity, demand for protection and other financial products often falls when consumers feel the pinch.

Three reasons to buy

Yet I still believe the company is a top stock to buy today. Firstly, I believe the threat of near-term sales weakness is baked into the cheapness of Aviva shares.

Secondly, the company’s resilience more recently suggests it could have what it takes to weather any industry downturn. Operating profit here rose 8% in the first half of 2023 as sales chugged higher.

And finally, the company is in good shape to grow revenues over the long term. As populations rapidly age in Europe and North America, demand for protection and retirement products should heat up. Aviva’s strong balance sheet gives it scope to capitalise on this through further acquisitions, too (its CET1 capital ratio was 200% as of September).